Outstanding crypto analyst Burak Kesmeci has tipped Bitcoin (BTC) to hit a worth goal of $124,000 based mostly on knowledge from the Golden Ratio Multiplier worth mannequin. This bullish prediction comes after a formidable worth surge up to now week, hinting that the premier cryptocurrency might have extra room for speedy worth development.

Can Bitcoin Return To 1.6x Accumulation Peak Goal?

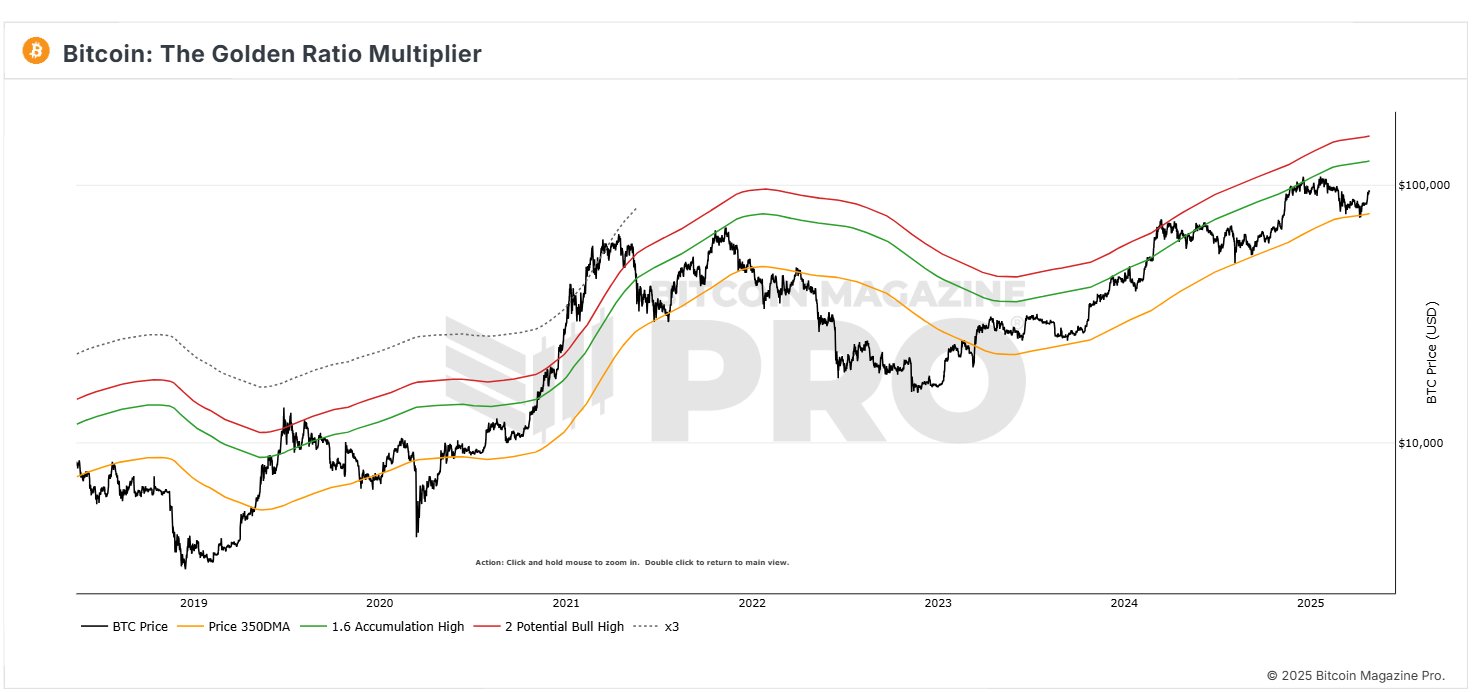

In an X publish on April 26, Burak Kesmeci shared the most recent updates on the Bitcoin Golden Ratio Multiplier worth mannequin, referencing knowledge from Bitcoin Journal Professional. For context, the Golden Ratio Multiplier mannequin makes use of shifting averages and Fibonacci ratios to assist determine when BTC could be overvalued or undervalued, thereby signaling doable market tops or good accumulation alternatives.

Based on the chart under, Bitcoin has just lately retested the 350 day by day shifting common (350DMA) at $77,000. Because the identify implies, the 350DMA tracks BTC’s common worth over the past 350 days and acts as a key help zone. Touching or briefly dipping under this stage usually indicators a possible long-term shopping for alternative.

Bitcoin just lately rebounded off its 350DMA, after a worth dip to $75,000 was adopted by two subsequent worth rallies to commerce as excessive as $96,000.

In step with the worth bands on the Golden Multiplier ratio, BTC is now headed for 1.6x Accumulation Excessive, i.e, 1.6 occasions the 350 DMA, which is at present at $124,000. Subsequently, regardless of the continuing worth consolidation, BTC is more likely to produce one other worth rally based mostly on the Golden Multiplier ratio worth mannequin.

Curiously, when Bitcoin strikes close to or above this stage, it usually indicators the top of an accumulation section and the beginning of a stronger bullish development. Subsequently, BTC reaching the $124,000 would solely pave the best way for additional worth good points consistent with the lofty targets of some market analysts.

BTC Miners Acquire $18.60 Million In Revenue

In different information, one other high crypto analyst, Ali Martinez, reviews that miners have just lately capitalized on Bitcoin’s spectacular worth rally, realizing almost $18.60 million in earnings as costs surged previous $94,000.

This realized revenue spike highlights that early miners are strategically taking earnings at these excessive worth ranges. Nonetheless, it’s value noting that Bitcoin retains a robust bullish momentum regardless of this promote strain, fueled by a number of components, together with sturdy inflows into spot ETFs.

On the time of writing, BTC is valued at $94,393, reflecting a worth decline of 0.76% up to now day.

Featured picture from Investopedia, chart from Tradingview

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our workforce of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.