On November 12, Solana’s (SOL) buying and selling quantity hit a four-month excessive of $12.60 billion amid the altcoin’s rally above $200. Nonetheless, the identical quantity is now lower than half of that, suggesting that Solana bears are guaranteeing that the value fails to rally towards $300.

However the query stays: Is a SOL rally not on the playing cards? This evaluation examines the possibilities.

Solana Sees Waning Curiosity, Low Exercise

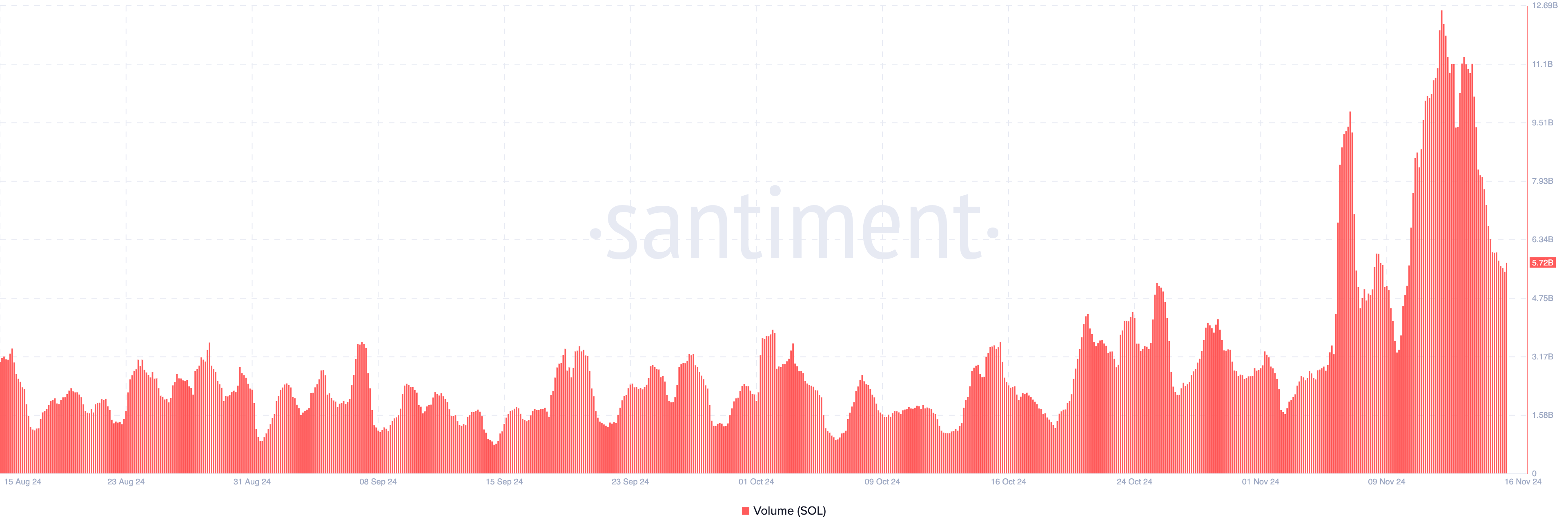

In accordance with Santiment, Solana’s quantity is all the way down to $5.72 billion. Within the crypto market, buying and selling quantity represents the full variety of cash or tokens exchanged throughout a selected interval. This key metric presents insights into market exercise and liquidity, serving to merchants assess the power of value actions and general curiosity in a specific asset.

From a value perspective, the rise in quantity alongside an increase in a crypto’s market worth is a bullish signal.

Nonetheless, on this case, the decline whereas the token trades at $216 means that Solana bears are limiting it from rousing larger. Thus, if the quantity continues to say no, Solana’s value may additionally observe a downward pattern.

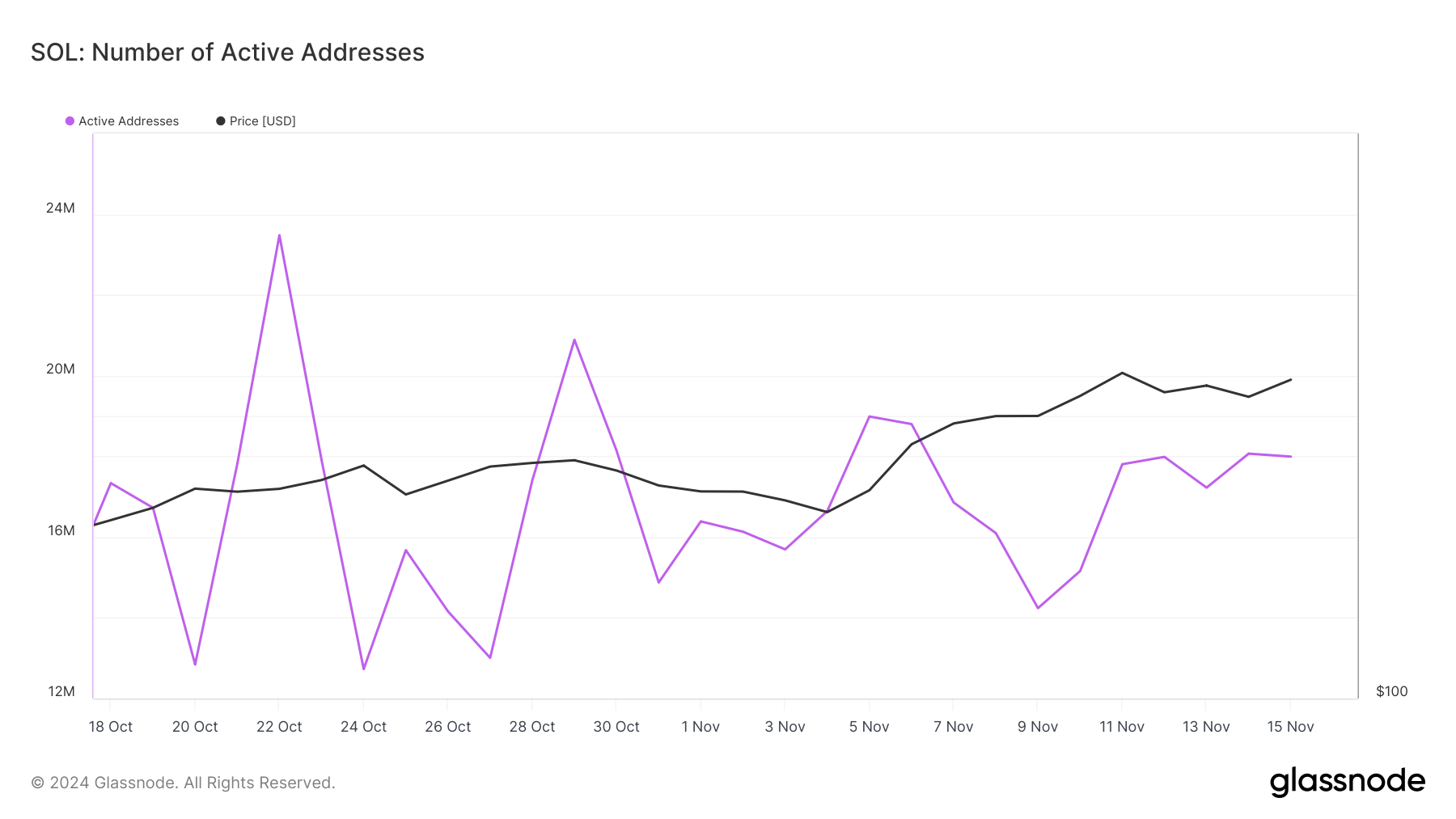

One other metric that impacts that is Solana’s lively addresses. Lively addresses measure the distinctive pockets addresses concerned in sending or receiving funds inside a selected timeframe. This metric displays community exercise and person engagement.

An increase in lively addresses usually indicators elevated adoption and utilization, which may positively affect a cryptocurrency’s value. Conversely, a decline might point out waning curiosity within the community, probably exerting downward stress on the value.

In accordance with Glassnode, Solana’s lively addresses declined from over 20 million over the last days of October to 17.98 million. If this lower continues, SOL won’t have sufficient person engagement to assist the uptrend.

SOL Value Prediction: Drop Beneath $200?

On the day by day chart, Solana bears pushed the value again as quickly because it hit $222.49. This pullback ensures that the altcoin’s hopes of reaching $300 have diminished. As talked about above, the quantity has decreased, which can be validated on the chart.

If that’s the case, Solana’s value might lower towards the $190.30 stage. This can occur if promoting stress will increase and SOL bears proceed to regulate the value route.

However, a rise in quantity accompanied by shopping for stress might invalidate this thesis. If that occurs, Solana’s value may cross above $225 into the $300 stage.

Disclaimer

According to the Belief Mission tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your personal analysis and seek the advice of with an expert earlier than making any monetary choices. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.