- SUI faces a $265 million token unlock on Could 1, releasing about 2.28% of the circulating provide, elevating issues about potential promoting strain after a powerful latest rally.

- On-chain fundamentals stay sturdy, with SUI’s TVL climbing 40% to $1.73 billion, stablecoin market cap rising, and each day DEX volumes holding regular round $500 million.

- If SUI holds above $3.60, it might push towards $4.00, however promoting strain might set off a pullback towards $3.30 and even $3.00 if the market struggles to soak up the unlock.

After a fairly explosive run-up, SUI is likely to be about to face a critical take a look at.

A $265 million token unlock is ready for this week — and yeah, it might convey some critical promoting strain into the market.

74 Million SUI Unlock Incoming

On Could 1, about 74 million SUI tokens — roughly 2.28% of the present circulating provide — shall be unlocked, in keeping with information from Tokenomist.

Now, simply to maintain issues in perspective — solely about 33% of the whole SUI provide has been unlocked thus far.

That means there’s nonetheless a whole lot of provide that might ultimately hit the market.

This upcoming unlock comes proper when demand for SUI has been heating up, so it’s organising a little bit of a showdown: can recent shopping for urge for food soak up the incoming provide with out sending costs tumbling?

Fundamentals Are Firing Up

Whereas the unlock might set off some volatility, SUI’s on-chain fundamentals have been crushing it these days:

- Complete Worth Locked (TVL) on SUI protocols jumped 40% since early April, now sitting at $1.73 billion (per DeFiLlama).

- The stablecoin market cap on Sui’s community climbed from $630 million to $880 million.

- Each day DEX quantity has been floating round $500 million — not too shabby.

- Over the previous week alone, the community’s dealt with greater than $3.6 billion in buying and selling, pushing month-to-month quantityabove $11 billion.

So, regardless of the token unlock looming, some merchants really see the strengthening fundamentals as a purpose to remain bullish — betting that SUI can soak up the strain with out a lot injury.

Present Value Motion: Bullish, However Warning Creeping In

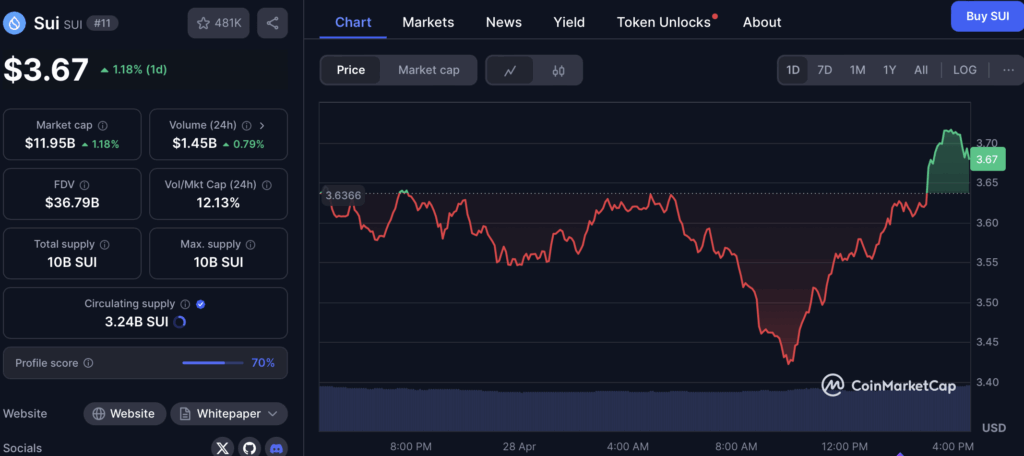

On the time of writing, SUI is buying and selling round $3.62, after smashing via the $3.30 resistance zone final week.

Key indicators nonetheless look fairly bullish:

- RSI is sitting at 78, which is technically overbought — so perhaps a little bit overheated, however not a crash sign by itself.

- Momentum indicators are nonetheless favoring the bulls.

- MACD? Nonetheless sitting good and constructive.

- All main transferring averages proceed flashing “purchase” alerts too.

Key Ranges to Watch

Right here’s the way it might play out:

- If shopping for strain holds: SUI may take a shot on the $4.00 psychological degree subsequent. A clear break there might hearth up extra momentum merchants.

- If promoting strain kicks in: SUI might slip again to $3.30 assist — that’s the earlier resistance zone it simply broke out of.

- In a deeper pullback: Eyes can be on the $3.00 degree, close to the 10-day EMA, as stronger assist.

If the market soaks up the unlock with out a lot drama?

SUI might settle into a brand new vary between $3.30 and $3.60 earlier than plotting its subsequent huge transfer.

Closing Ideas: Huge Check Forward for SUI

The stage is ready for a vital week.

Between the bullish technicals, the rising fundamentals, and the $265M unlock, SUI’s about to seek out out simply how sturdy its rally actually is.