- HBAR defied bearish indicators after a demise cross on April 14, rallying 20% in two weeks as broader markets rebounded.

- Momentum has slowed, however MACD nonetheless favors bulls, and the token stays in an ascending trendline sample.

- If upward momentum holds, HBAR may break $0.19 and purpose for $0.23; if sellers step in, a drop to $0.15 is feasible.

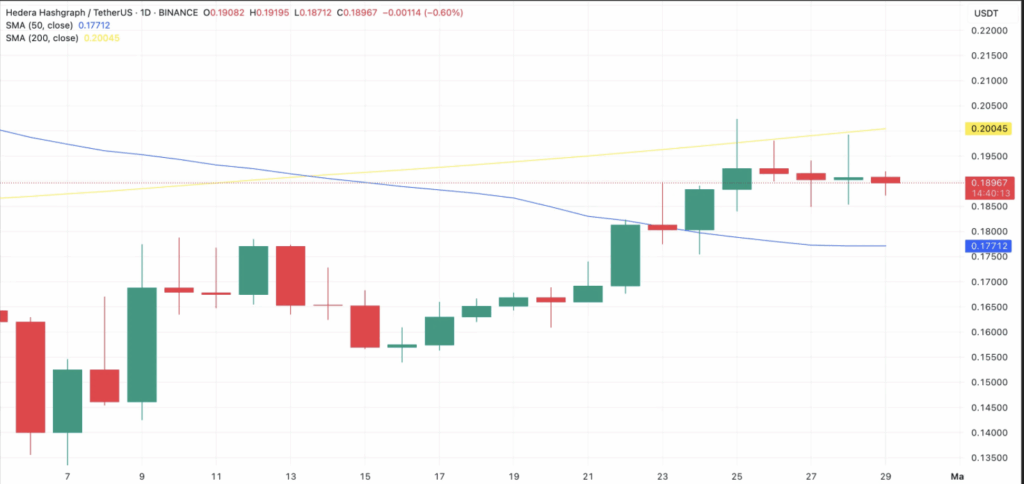

So, a demise cross confirmed up on HBAR’s day by day chart again on April 14—a traditional warning signal that issues would possibly head south. Usually, when the 50-day transferring common dips under the 200-day, it units off alarms for merchants. However, seems, HBAR didn’t get the memo.

As a substitute of tumbling, the token flipped the script and rallied about 20% over the past couple of weeks. Yep, even with that ominous sign in play.

Wait—Wasn’t This Speculated to Be Bearish?

Let’s break it down. A demise cross normally factors to weakening momentum and hints {that a} longer-term downtrend is setting in. Merchants see it and sometimes brace for promoting strain. It’s like a pink flag flapping within the wind, warning of doable turbulence forward.

However crypto’s gonna crypto. HBAR simply type of shrugged it off and soared as an alternative, fueled by a broader market rebound. This isn’t unusual both. In fast-moving or restoration phases, technical indicators like these can get… properly, ignored.

MACD Nonetheless Flashing Inexperienced(ish)

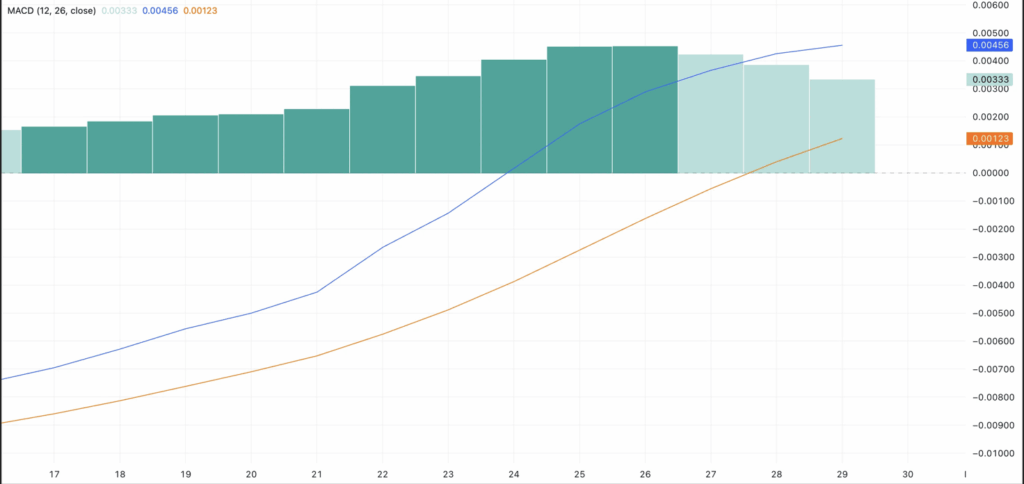

Now, it’s true—bullish momentum has eased a bit over the previous couple of buying and selling classes. The MACD histogram bars? They’re shrinking. Not splendid should you’re a bull. However right here’s the excellent news: the MACD line remains to be above the sign line. In easy phrases, the patrons are nonetheless pushing.

So whereas issues have cooled off, we’re not in reversal territory simply but.

Driving That Trendline – Or Risking a Slide?

Since April 16, HBAR’s been cruising alongside a pleasant upward trendline. That’s the sample you wish to see—increased lowsstacking up over time. It tells you traders aren’t panicking. They’re really stepping in at higher positions, which builds stable assist.

Now, if this sample holds, HBAR may punch via the $0.19 resistance and perhaps even chase $0.23. That’s the bullish path.

However let’s be actual—if the market turns bitter or if patrons again off, HBAR would possibly slide again to check that $0.15 assist zone. Nothing’s assured, particularly in crypto.

Backside Line

Dying cross or not, HBAR’s been on a little bit of a run. The bulls haven’t given up management but, and if sentiment holds up, there’s room for extra upside. However yeah, regulate the trendline and people resistance ranges. If the temper adjustments, $0.15 may very well be the subsequent pit cease.

Keep cautious. Keep curious.