Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Ethereum is buying and selling slightly below the $2,000 mark, holding at essential ranges because the broader market reveals indicators of restoration. After weeks of uneven value motion and fading promoting stress, bulls are progressively regaining management, pushing ETH right into a extra bullish short-term construction. Momentum is constructing as Ethereum stabilizes above the $1,800 degree, and technical indicators recommend a breakout could also be forming.

Associated Studying

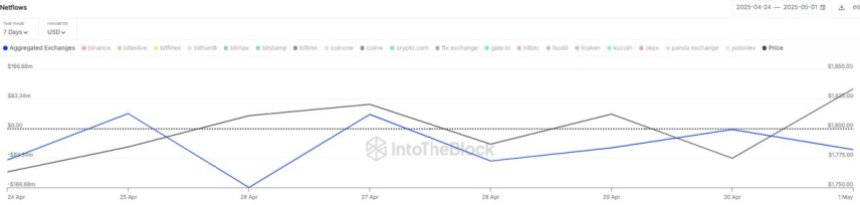

Including to the rising optimism, on-chain knowledge from IntoTheBlock reveals a constant stream of ETH out of centralized exchanges—an indicator usually related to accumulation and diminished sell-side stress. Over the previous week alone, internet outflows have exceeded $380 million value of Ethereum, reinforcing the view that buyers are making ready for a transfer greater.

Nonetheless, the important thing resistance at $2,000 stays a psychological and technical barrier. A confirmed push above this degree might set off a broader altcoin rally and sign the beginning of Ethereum’s subsequent leg up. Till then, the market stays cautiously optimistic as bulls take a look at the higher limits of this consolidation zone, searching for the momentum wanted to flee it.

Ethereum Faces Essential Check Amid Accumulation Development

Ethereum continues to face headwinds because it trades greater than 55% beneath its December highs, hovering beneath the $2,000 resistance zone. Whereas the broader crypto market reveals indicators of revival, ETH stays locked in a essential battle between provide overhead and renewed shopping for curiosity. The current value construction reveals some bullish growth in decrease time frames, as consumers try to construct momentum. Nonetheless, sturdy resistance ranges nonetheless loom, and failure to interrupt by way of might set off a contemporary transfer into decrease demand zones round $1,700 and even $1,500.

Regardless of these technical challenges, on-chain knowledge paints a extra encouraging image. Based on IntoTheBlock, centralized exchanges have seen internet Ethereum outflows of roughly $380 million during the last seven days. This regular discount in exchange-held ETH suggests a rising development of accumulation, usually interpreted as buyers transferring cash to chilly storage moderately than making ready to promote. This habits sometimes reduces sell-side stress and might lay the groundwork for extra sustainable rallies.

Market sentiment stays combined. Some analysts argue that Ethereum is gearing up for a breakout, with shifting momentum hinting at an imminent surge. Others stay cautious, warning that macroeconomic uncertainty and fragile investor confidence might nonetheless pull ETH right into a deeper correction. The approaching days might be essential in defining Ethereum’s trajectory.

Associated Studying

ETH Value Evaluation: Testing Key Resistance

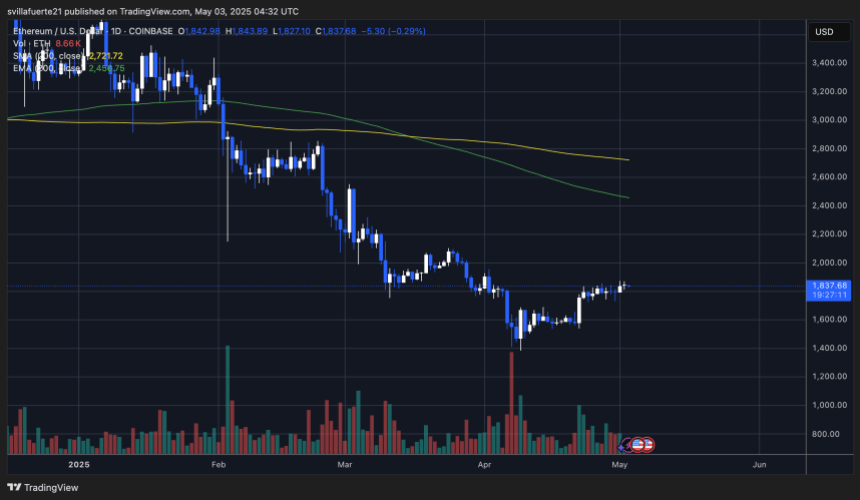

Ethereum (ETH) is at the moment buying and selling at $1,837 after a number of days of consolidation slightly below the $1,850 degree. As seen within the day by day chart, ETH has been making an attempt to kind a short-term bullish construction after rebounding from April lows close to $1,550. The worth has steadily climbed however now faces vital resistance close to $1,850—a degree that has acted as each assist and resistance in earlier months.

Quantity has been comparatively secure however not convincingly excessive, indicating that bulls are gaining management however lack sturdy momentum to interrupt by way of. The 200-day Easy Shifting Common (SMA) at $2,271 and the 200-day Exponential Shifting Common (EMA) at $2,456 stay distant overhead targets. These ranges signify key longer-term resistance, and reclaiming them can be a serious bullish sign.

Associated Studying

For now, ETH should shut decisively above $1,850 to validate this short-term development reversal. A failure to take action could end in one other retest of assist round $1,700 and even decrease, notably if broader market sentiment shifts. Nonetheless, the value holding above current swing lows and forming greater lows indicators that bullish stress is constructing progressively. A breakout above $1,850 would open the door to a transfer towards the $2,000–$2,200 zone.

Featured picture from Dall-E, chart from TradingView