Folks are inclined to rejoice intervals of low feerates. It’s time to scrub home, consolidate any UTXOs you might want to, open or shut any Lightning channels you’ve been ready on, and inscribe some silly 8-bit jpeg into the blockchain. They’re perceived as a optimistic time.

They aren’t. We’ve got seen explosive worth appreciation the previous few months, lastly hitting the 100k USD benchmark that everybody took without any consideration as preordained over the last market cycle. That’s not regular.

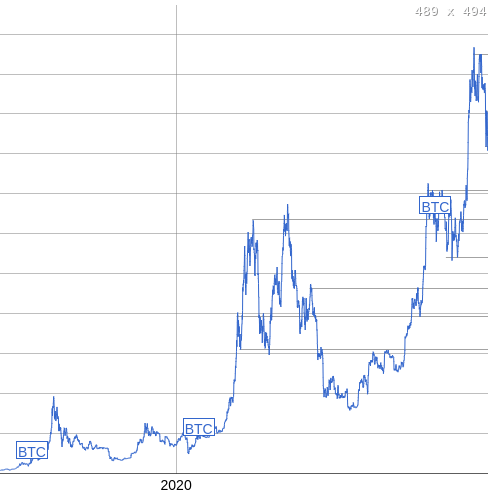

The image on the left is the common feerate every day since 2017, the image on the best is the common worth every day since 2017. When the value was pumping, when it was extremely risky, traditionally we’ve got seen feerates spike accordingly. Usually matching the expansion and peaking when the value did. The individuals truly shopping for and promoting transacted on-chain, individuals took custody of their very own cash after they purchased them.

This final leg as much as over 100k doesn’t appear in any respect to have had the identical proportional have an effect on on feerates that even strikes earlier on this cycle have. Now, in the event you truly did take a look at each of these charts, I’m certain many individuals are going “What if this cycle is on the finish?” It’s potential, however let’s say it’s not for a second.

What else might this be indicating? That the members which might be driving the market are altering. A gaggle of people that was once dominated by people who self custodied, who managed their counterparty threat by eradicating good points from exchanges, who generated time-sensitive on-chain exercise, are remodeling into a bunch of individuals merely passing round ETF shares that haven’t any want of settling something on-chain.

That isn’t a very good factor. Bitcoin’s very nature is outlined by the customers who work together with the protocol instantly. Those that have non-public keys to authorize transactions producing income for miners. Those that are despatched funds, and confirm transactions in opposition to consensus guidelines with software program.

Each of these issues being faraway from the fingers of customers and positioned behind the veil of custodians places the very stability of Bitcoin’s nature in danger.

This can be a critical existential concern that must be solved. The complete stability of consensus round a particular algorithm is premised on the belief that there are sufficient unbiased actors with separate pursuits that diverge, however align on a price gained from utilizing that algorithm. The smaller the group of unbiased actors (and the bigger the group of individuals “utilizing” Bitcoin via these actors as intermediaries) the extra sensible it’s for them to coordinate to basically change them, and the extra doubtless it’s that their pursuits as a bunch will diverge in sync from the pursuits of the bigger group of secondary customers.

If issues proceed trending in that route, Bitcoin very properly might find yourself embodying nothing that these of us right here in the present day hope it might probably. This downside is each a technical one, by way of scaling Bitcoin in a approach that enables customers to independently have management of their funds on-chain, even when solely via worst-case recourse, however it is usually an issue of incentive and threat administration.

The system should not solely scale, but it surely has to have the ability to present methods to mitigate the dangers of self custody to the diploma that individuals are used to from the normal monetary world. A lot of them really want it.

This isn’t only a scenario of “do the identical factor I do as a result of it’s the one appropriate approach,” that is one thing that has implications for the foundational properties of Bitcoin itself in the long run.

This text is a Take. Opinions expressed are solely the writer’s and don’t essentially replicate these of BTC Inc or Bitcoin Journal.