- Traders are in full “high-risk” mode, scrambling to defend their portfolios from any extra losses

- Risk of a market crash is not a distant chance.

A fast look again on the final ten days reveals how traders are bracing for a unstable 2025. The crypto market cap tells us a story too, falling from $3.80 trillion to $3.29 trillion – Marking a pointy 13.42% decline.

Nevertheless, this may increasingly solely be the beginning of what’s to return. Bitcoin’s [BTC] ‘excessive threat, excessive reward’ attraction will quickly face its greatest take a look at. With the Fed adopting a ‘cautious’ stance, we may be seeing the tip of a a lot bigger financial storm brewing within the U.S.

Traders are waking up. From the bond market to shares, the panorama is shifting, and the standard election tendencies are reversing. So, the place does the crypto market, and particularly Bitcoin, match into this evolving image?

Investor portfolios shift in the direction of threat aversion

Bitcoin’s latest collapse from its $108k all-time excessive wasn’t a results of an overheated market. Actually, high-caps have been nonetheless up for grabs. So, who’s responsible? Effectively, many critics pointed to the FOMC charge minimize because the set off.

Usually, an rate of interest minimize indicators a ‘wholesome’ economic system, boosting buying energy by making borrowing cheaper and inspiring spending throughout the combination market. Nevertheless, traders’ reactions have been removed from what you’d count on.

Take into account this – The ten-year Treasury yield has surged by 100 foundation factors since September, hitting a 6-month excessive – Proper alongside a pointy uptick in inflation.

Supply : Buying and selling Economics

To make issues extra regarding, the Fed has raised its 2025 inflation forecast to 2.5%, up from 2.1% in September. Much more worrying, the central financial institution now expects inflation to hit its 2% goal by 2027, as an alternative of 2026 as beforehand projected.

This brings us to an attention-grabbing level – Was this sudden BTC value drop a traditional ‘sell-the-news’ second, one the place panicked traders scrambled to tighten their portfolios? An exit pushed much less by chilly exhausting knowledge and extra by the ‘assumption’ {that a} U.S. recession is on the horizon – A brief blip, maybe?

Effectively, there’s extra beneath the floor. Particularly for the reason that U.S. could possibly be looking at financial issues quickly, a actuality you’ll wish to preserve a detailed eye on within the days forward.

A actuality test on the debt disaster forward

The rise in Treasury yields, regardless of the rate of interest minimize, marks a transparent shift – Retail traders are pulling out of the crypto market. Fearing what’s forward, they’re flocking to conventional ‘secure havens,’ betting on greater returns as financial uncertainty builds.

However what’s behind this uncertainty? In 2025, a staggering $7.6 trillion in U.S. debt is due. To handle this, the federal government should refinance or pay it off by issuing new bonds – Doubtless with greater rates of interest, a transfer that may be a signal of the Fed’s warning.

This might set off a monetary disaster, sending shockwaves via the worldwide economic system. Larger charges will make borrowing costlier, slowing investments and financial progress.

So, as an alternative of diversifying, many traders are doubling down on the bond market, hoping to money in on the monetary turmoil that’s coming. The affect on BTC is already exhibiting too, with some analysts predicting that the market correction might develop into a “bullish” signal.

Nevertheless, there’s additionally concern that we would see a repeat of the brutal 2022 cycle, probably trapping BTC in one other long-term bearish part.

The one factor that might save BTC traders

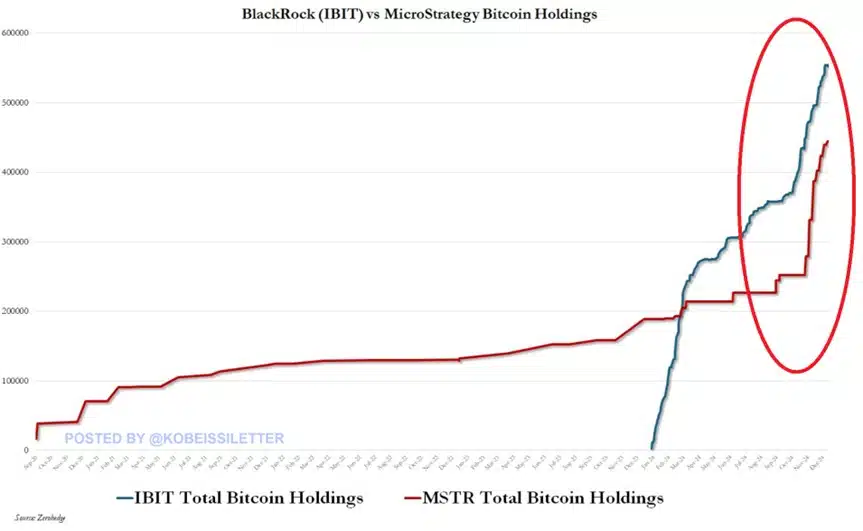

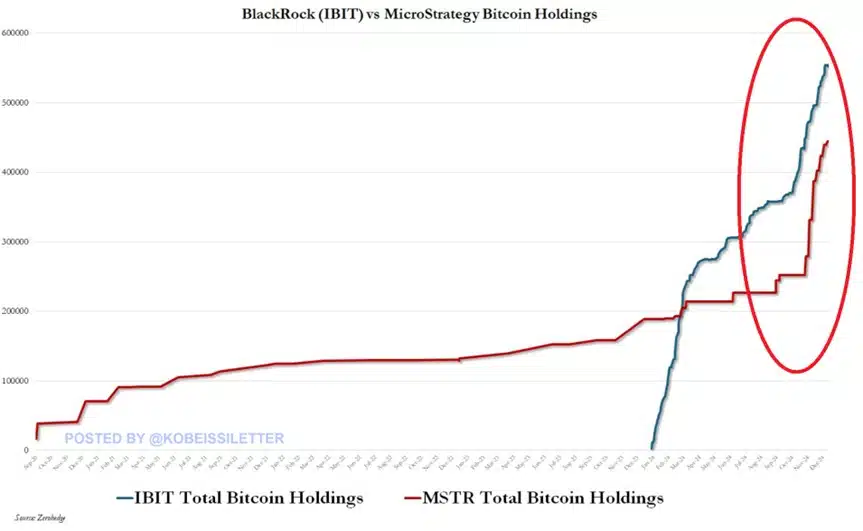

From 2022 to 2024, one of many greatest shifts has been the surge of institutional capital pouring into BTC.

With the mixed Bitcoin holdings of the main crypto ETFs, IBIT, and MicroStrategy (MSTR) now reaching a staggering 996,290 BTC, it’s clear – Institutional traders are all-in on Bitcoin’s long-term potential.

Collectively, these two giants management practically 4.7% of all the Bitcoin provide.

Supply : ZeroHedge

As a large debt storm brews, these institutional heavyweights might want to take motion to assist Bitcoin’s flagging attraction – Doubtlessly sparking a provide shock.

Alas, it’s a high-stakes gamble. With 2025 poised for volatility and retail traders flocking to Treasury yields, a repeat of the 2022 cycle feels dangerously shut.

Learn Bitcoin’s [BTC] Value Prediction 2025-26

The united stateseconomy is on shaky floor, and the monetary system is shifting. Whether or not Bitcoin will play a job within the new financial order is unsure.

For now, establishments maintain the wheel, and the crypto market may but pull off one other shock. Tread fastidiously although, as issues are removed from secure.